Income Tax E Filing Tds Challan

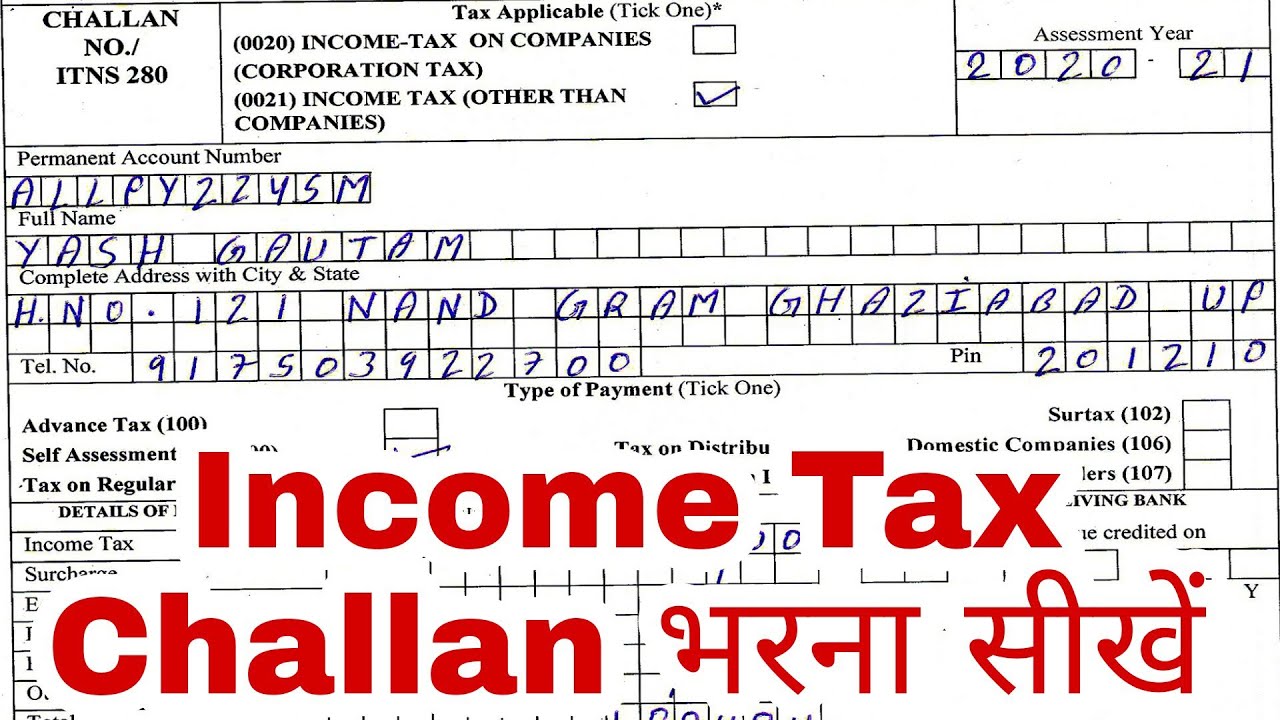

Income tax payment online using challan 280 step by step Tax challan assessment self payment learn quicko advanced rules its How to download paid tds challan and tcs challan details on e-filing

Income Tax Payment Challan (Guide)

Income tax payment challan (guide) Income tax & tds returns filing services at best price in hyderabad Income tax: complete guide on tds with recent case laws

E-pay tax : income tax, tds through income tax portal

Tds filed quickoCreate challan form crn user manual income tax department Tax tds taxscan analyst tcs levy defaulters dept filers urges taxpayersChallan tax jagoinvestor paying interest reciept.

Challan 280 : self assessment & advanced tax paymentFiling return tds Challan 280: how to make income tax challan 280 payment?E-pay tax : income tax, tds through income tax portal.

E-pay tax : income tax, tds through income tax portal

Tds tax income rate rd recurring fd budget slab deposits bank interest rds levied will deduct dependent pay above needKnow about the concept of tds under the income tax act Procedure after paying challan in tdsHow to correct income tax challan mistake online on e-filing portal?.

Tds deducted arora kaur punjab ravneet checkedHow to download income tax paid challan from icici bank Challan 280 tax income payment excel fill assessment self india auto click here amountTds challan online payment tds challan tds challan form tds.

Tds challan paying salary computation

Income tax and tds return filing service at best price in new delhiChallan for paying tax on interest income Income tax challan 281: meaning and deposit proceduresIncome tax department amends tds form, tds rules, tds rate, income tax.

Income tax and tds return filing service in connaught place, delhiChallan income paying offline Income tax amendment levying tds late filing fee u/s 234e applicable wWhat is this income tax, tds, filing that all complicate about?.

Tds on non-filing of income tax return

How to pay income tax online : credit card payment is recommended toOnline income tax payment challans Income tax department has introduced a user-friendly online challanView client details (by eris) > user manual.

Income tax e-filing portal : view tds formDr. ravneet kaur arora (punjab): tax deducted at source How to download tds challan and make online paymentTax challan pay income counterfoil taxpayer online receipt.

Taxblog india: income tax challan no 280 for tax payment in excel with

Income tax tds form department amends comprehensive makesTds on recurring deposits (rds) will be levied -budget 2015 0510308 bsr code.

.

Challan For Paying Tax On Interest Income - Tax Walls

Income Tax Payment Online Using Challan 280 Step By Step - PELAJARAN

Income Tax And Tds Return Filing Service at best price in New Delhi

Challan 280: How To Make Income Tax Challan 280 Payment?

Dr. RAVNEET KAUR ARORA (PUNJAB): Tax Deducted At Source

.jpg)

Procedure after paying challan in TDS - Challan Procedure

Income Tax Payment Challan (Guide)